News

Protein Power Packs a Punch

17 Nov 2014Interest in protein content and high protein products is continuing to grow across the food and drinks market, despite the fact that most North American and European consumers already have more than enough protein in their diets. This has been driven by increasing health concerns, boosted by the move of specialist sports and performance products […]

Interest in protein content and high protein products is continuing to grow across the food and drinks market, despite the fact that most North American and European consumers already have more than enough protein in their diets. This has been driven by increasing health concerns, boosted by the move of specialist sports and performance products into the mainstream, often targeted at the more generally active rather than athletes and sportsmen in particular. Links between protein intake and weight management and satiety are also increasingly being made.

Innova Market Insights data indicate that over 3% of global food and drinks launches in the 12 months to the end of September 2014 were marketed on a high-protein or source-of-protein positioning, rising to 6.5% in the US. There have been increasing numbers of products introduced on a high-protein platform across the food and drinks industry, led by cereal products and dairy products with about 18% of the total each. Other categories with significant numbers of launches include meat, fish and eggs, snacks and ready meals.

Cereal bars make up the largest individual category with 12% of global introductions on a protein platform, equivalent to over a quarter of total cereal bar launches over the same period, rising to over 45% in the US. The inclusion of higher levels of protein and more focus on its use has been one of the most obvious features of NPD in recent months. Additions to the US market have included Clif Kid Zbar Protein, Strong & Kind from KIND Healthy Snacks and Lean Protein & Fiber Bars from thinkThin.

Another key area of focus in recent years has been the dairy sector, where protein is increasingly being used as a marketing platform linking benefits for muscles and bones with general associations with sporty and health-conscious lifestyles. Over 7% of global dairy launches used protein claims in the 12 months to the end of September 2014, rising to 19% in the US.

Activity was initially centred largely on milk and dairy-based protein drinks, particularly sports and recovery lines, but more recently yogurt has emerged as a key high-protein growth market, largely as a result of the rising popularity of Greek yogurt.

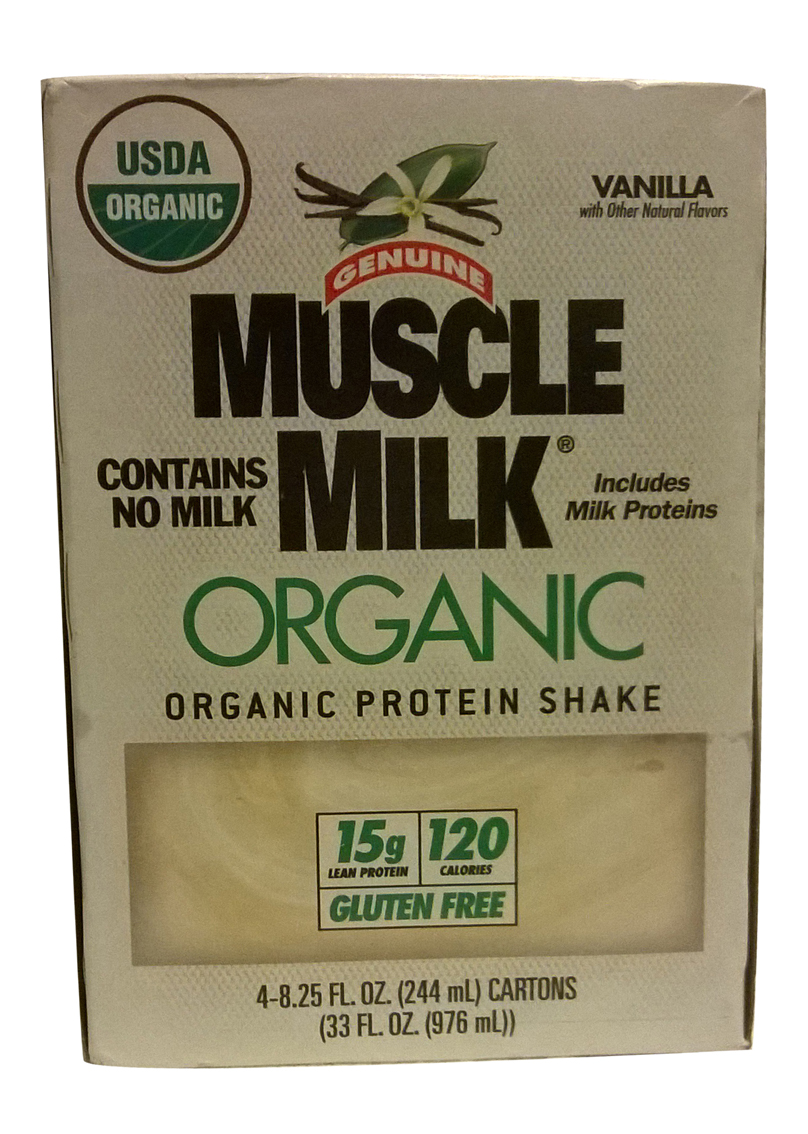

In the US, the markets for sports and protein drinks are reported to be transitioning from being separate categories to the emergence of one overall sports performance market. An early driver was CytoSport; although originally targeting athletes, its Muscle Milk brand has increasingly been positioned as a supplement for the ‘everyday athlete,’ appealing to the ‘hip to be fit’ crowd. More mainstream interest in the sector is also reflected in the acquisition of the company by Hormel Foods in the summer of 2014. Hormel reported that CytoSport aligned with its own focus on protein while diversifying its portfolio and expanding its offerings of portable, immediate, protein-rich foods. Geographical availability of Muscle Milk is also expanding, as seen in its launch onto the German market in the spring of 2014.

The rise of Greek-style strained yogurts, which are inherently higher in protein than standard lines, has paved the way for the wider positioning of yogurts on a high-protein platform. This has proved particularly useful in Europe, where labelling issues over when a product can be called ‘Greek’ has resulted in repositioning for a number of brands, perhaps most notably Danone’s Danio and Chobani, both of which ended up using a thick and creamy, high protein positioning in the UK after dropping the ‘Greek’ from their names.

High-protein foods and drinks are one of the most sought-after nutritional choices of the moment and we are seeing this move out of the US, where it is now virtually a mainstream trend, and into other regions, most notably Europe.

Related news

Retail landscape lacks nutritious and affordable food, says ATNi

30 Dec 2025

A rapid increase in modern food retail has given retailers growing influence over consumer diets, according to global non-profit ATNi’s latest assessment.

Read more

Debate over ban on ‘meaty’ names for plant-based products reaches stalemate

26 Dec 2025

The debate over a ban on plant-based products using “meaty” terms has reached a stalemate, leaving manufacturers in limbo and still facing overhauls to their marketing and packaging.

Read more

Innovation promise in 'maturing' plant-based dairy alternatives market

8 Dec 2025

Plant-based dairy is a maturing market that still faces significant hurdles around taste, functionality, nutrition, and price, but industry is innovating fast, according to experts speaking at Fi Europe.

Read more

Celebrating the winners of the Fi Europe Innovation Awards 2025

3 Dec 2025

Food industry stakeholders celebrated as the winners of the Fi Europe Innovation Awards were announced at a ceremony in Paris.

Read more

Big appetite for M&A between European and US food and drink companies

3 Dec 2025

Persistent tariffs on EU food and beverage exports have helped drive record levels of M&A activity between European and US companies this year, according to analysis by ING.

Read more

Non-UPF Program extends certification scheme to entire food industry

30 Nov 2025

The Non-UPF Program has extended its certification scheme to the wider food sector, championing a move towards healthier consumption habits.

Read more

Empowering innovation in fortification and colouration

13 Nov 2025

Divi’s Nutraceuticals offers a large portfolio of innovative, high-quality ingredients for foods, beverages, and supplements, with bespoke solutions and expert support for product success.

Read more

Danone highlights digestive health as potential ‘tipping point’ for food industry

13 Nov 2025

Danone is betting on a food industry “tipping point” that will bloat the market for healthy products, particularly those related to gut health.

Read more

Standing Ovation and Bel scale up casein production from dairy co-products

11 Nov 2025

Foodtech company Standing Ovation has partnered with cheese specialist Bel Group to manufacture dairy serums for industrial-scale casein production via precision fermentation.

Read more

New UPF standard hoped to offer consumers ‘coherence and clarity’

10 Nov 2025

Ingredients companies are being urged to enter “a new era of partnership and innovation” following the launch of the industry’s first non-UPF verification scheme.

Read more