News

Could alternative sourcing be the future of CBD?

28 Feb 2023

Sales growth of food and drink products containing CBD has fallen drastically in recent years, largely due to regulatory and consumer acceptance issues. Some companies are exploring new sources, such as CBD made from the terpenes in orange peel.

Cannabinol (CBD) sales growth in the food and drink industry in the US fell off a cliff in recent years. Though sales of CBD saw a meteoric rise in 2018 and 2019, they have since declined drastically in 2020 and 2021, according to a report by the Nutrition Business Journal. In 2019, hemp-derived CBD growth peaked at around 90%, yet fell to negative figures in 2020 where it has remained ever since.

This downward trend in sales growth is set to continue, according to the same report, which predicts further stable declines each year in the foreseeable future. This is partly due to the fact that many leading industry regulators, including the FDA, have continually refused to regulate food and drink products containing CBD.

Regulation is stifling CBD market growth

The potential of hemp-derived CBD in food and beverage products has been a hot topic in recent years, with many companies eagerly investing in the ingredient in anticipation of a profitable future. Unfortunately, regulation (or the lack thereof) of CBD ingredients has presented itself as a common stumbling block for brands seeking to incorporate CBD ingredients in product formulations.

In yet another hit to the sector, on 26 January 2023, the FDA announced a refusal to regulate CBD products following a consumer petition calling for their approval to be marketable as dietary supplements. In a statement, the FDA’s principal deputy commissioner Janet Woodock expressed concerns about the long-term safety risks associated with the consumption of CBD.

“Studies have shown the potential for harm to the liver, interactions with certain medications and possible harm to the male reproductive system,” Woodock said.

Concerns were also raised regarding the effect of CBD containing products on children and pregnant women.

The FDA’s recent announcement could render the future of CBD as an ingredient in food and drink products even more uncertain, much to the disappointment of industry stakeholders.

CBD derived from alternatives sources could solve consumer acceptance issues

Despite the regulatory setbacks, there may still be hope for the industry. The European CBD market is expected to grow to €2.6 billion, with users of the ingredient reaching 50 million by 2026, a recent report by UK-based market research company, Prohibition Partners, found.

© AdobeStock/New Africa

© AdobeStock/New Africa

The uptick in consumer interest in CBD products in recent years has led to a flurry of startups and industry players seeking to explore the possibilities of using CBD as a food ingredient, sparking innovation in the food industry.

To bypass barriers to consumer acceptance associated with cannabis-derived CBD, several companies are experimenting with CBD derived from alternatives sources, such as orange peel or hops. US-based CBD company Peels developed an oil which it claims is bio-identical to pure hemp-based CBD but is made from the terpenes found in orange peel.

Major flavour producer Symrise has produced a nature-identical, synthetically formulated CBD that is suitable for use as a pharmaceutical ingredient and as an immediate product for the development of new substances. The basis for the active ingredient, D-limonene, is derived from a group of terpenes and is a by-product of the orange juice industry.

In future, brands may benefit from growing consumer acceptance from millennial and gen Z consumers. In the US, Mintel data from 2021 shows that 17% of consumers are interested in trying hemp-derived CBD, compared to 26% of consumers aged 25-34.

Related news

Bone broth: From old-fashioned to en vogue

24 Nov 2025

OXO’s entry into bone broth has turned the spotlight on this small but high-performance category – and there is still scope for growth, especially in the area of GLP-1 support.

Read more

Matcha madness: Why green is this year’s hottest colour

19 Nov 2025

Five years ago, it was a struggle to find matcha outside of Japan. Now it seems to be popping up everywhere, from coffee shops to supermarket shelves.

Read more

How younger consumers are redefining ingredient choices and rejecting brand loyalty

18 Nov 2025

Gen Z and millennial consumers’ preferences for transparency, functionality, and purpose are “redefining the very nature of consumption itself”, says SPINS.

Read more

Hybrid formats and flexible positioning to disrupt category norms in 2026

17 Nov 2025

Trend forecasters expect food and drink to move more fluidly across occasions, functions, and formats as consumers seek versatility, novelty, and convenience.

Read more

Empowering innovation in fortification and colouration

13 Nov 2025

Divi’s Nutraceuticals offers a large portfolio of innovative, high-quality ingredients for foods, beverages, and supplements, with bespoke solutions and expert support for product success.

Read more

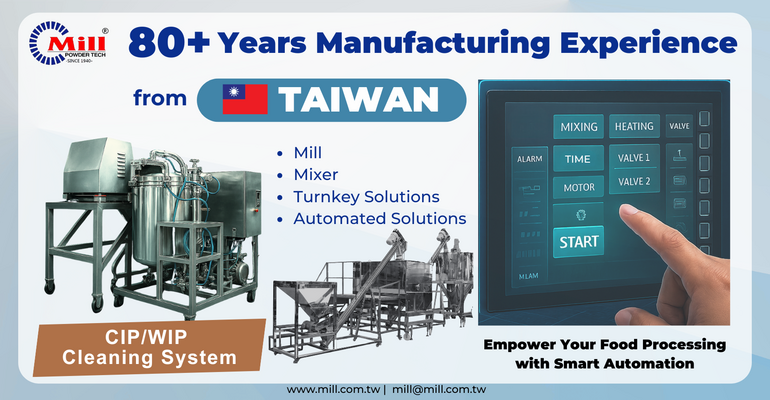

Predictive maintenance redefines powder mixing reliability

13 Nov 2025

Mill Powder Tech's smart control systems harness real-time data to help the food and biotech sectors achieve zero downtime and smarter output, alongside rigorous GMP standards and ambitious ESG goals.

Read more

From fruit to functional solutions: Meet Paradise Fruits at Fi Europe in Paris

13 Nov 2025

Paradise Fruits Solutions and Paradise Fruits Health will showcase their combined expertise in delivering innovative, fruit-based solutions to the food and beverage industry at the upcoming Fi Europe trade show (2-4 December 2025, Paris).

Read more

Danone highlights digestive health as potential ‘tipping point’ for food industry

13 Nov 2025

Danone is betting on a food industry “tipping point” that will bloat the market for healthy products, particularly those related to gut health.

Read more

Bord Bia presents Irish dairy ingredient suppliers at Fi Europe

6 Nov 2025

Dairygold Co-operative Society, The Carbery Group, and Ornua Co-operative: Meet with sustainable producers of Irish dairy ingredients at Food ingredients Europe 2025, Hall 7.2 Stand M18.

Read more

Ingredient quantities mislabelled on popular protein bars, independent tests show

5 Nov 2025

Some popular protein bars contain more fat, carbs, and/or sugars than claimed on their labels, independent nutrition testing reveals.

Read more