News

European Juice-Makers Offer Vegetable Innovation

5 Jun 2012The Mintel Inspire trend A Simple Balance for Health maintains that “simple, uncomplicated habits are always a good option. Sticking with the basics is a surefire way for brands to score with health-seeking consumers.” In the juice segment, vegetable blends are one example of a back-to-basics approach. They balance out the need for both fruit and vegetables, […]

The Mintel Inspire trend A Simple Balance for Health maintains that “simple, uncomplicated habits are always a good option. Sticking with the basics is a surefire way for brands to score with health-seeking consumers.”

In the juice segment, vegetable blends are one example of a back-to-basics approach. They balance out the need for both fruit and vegetables, and as consumers a growing number of countries face obesity issues, vegetables’ lower sugar and calorie levels offer an option for keeping those factors in check.

In Europe, vegetable juice introductions are back on the rise after dropping considerably for several years. Juices that use vegetable as a flavor component (which excludes products that contain vegetable juice and extracts only for natural color) fell by more than half between 2007 and 2010. But they began climbing again last year, and this year have already seen nearly as many introductions as all of last year.

Spain, Italy, Belgium and the Czech Republic all have increased their share of Europe’s vegetable juice introductions during the past two years. Germany has retained its position at the top of the list, although its share of overall introductions in the region dropped slightly.

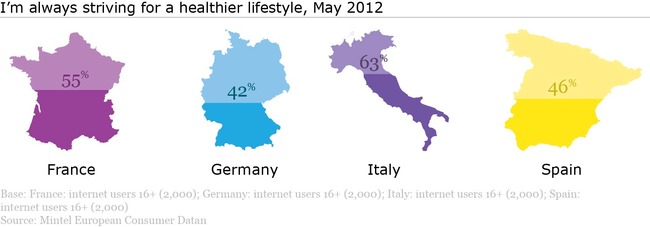

Consumers in Europe report that they are trying to live healthier. In fact, more than half (55%) of consumers in France and a nearly two-thirds of those in Italy say they are always striving for a healthier lifestyle. Those percentages are slightly lower for Germany and Spain (42% and 46%, respectively), but still significant. That seems to offer a chance for juice to promote vegetable content as well as fruit for a wider range of nutrients.

While a number of the new European vegetable juice rollouts are veg-only, fruit and vegetable blends continue to become more popular. So far this year, fruit, citrus fruit and berry blends have accounted for 63% of introductions.

Carrot is the go-to vegetable for blends, accounting for 46% of the products introduced in Europe so far this year. That’s followed by tomato, which can be found in 26% of introductions in 2012. Beetroot accounts 9% of introductions so far this year, building on the vegetable’s growing reputation for lowering blood pressure, increasing stamina and athletic performance, and fighting inflammation.

Like consumers in most regions, European consumers report that they find it difficult to get the recommended five servings of fruits and vegetables a day. Interestingly, at 61%, consumers in Germany are among the most likely to say they struggle to meet their five-a-day. That means despite the number of vegetable-based juices on the market, consumers are not seeing them as part of their consumption goals. Juice-makers seem to be missing the opportunity to tie their vegetable juice products to these goals.part of their consumption goals.

Consumers across Europe report swapping out less-healthful snacks for fruits and vegetables, but some still prefer their veg to be blended in with something else rather than consumed straight up. Not surprisingly, younger consumers are most likely to say they prefer vegetables blended into smoothies or soup. In Italy, 29% of those under age 25 prefer consume vegetables this way, as do 28% of under-25s in Spain and 21% in Germany. That leaves potential for juice-makers that can appeal to these younger consumers by blending the vegetables they know they should be eating into a more preferred format.

As consumers become more comfortable and familiar with vegetable-based juices, drink-makers can look to the East for new concepts. Japan and China are the two leading vegetable juice innovators globally, with Japan accounting for 13% of global introductions so far this year and China 9%.

Related news

Retail landscape lacks nutritious and affordable food, says ATNi

30 Dec 2025

A rapid increase in modern food retail has given retailers growing influence over consumer diets, according to global non-profit ATNi’s latest assessment.

Read more

Debate over ban on ‘meaty’ names for plant-based products reaches stalemate

26 Dec 2025

The debate over a ban on plant-based products using “meaty” terms has reached a stalemate, leaving manufacturers in limbo and still facing overhauls to their marketing and packaging.

Read more

Multi-sensory food and drink products to gain traction in 2026

16 Dec 2025

Trend forecasters predict that sensory elements will play a larger role, helping food and beverage brands differentiate themselves in a competitive market in 2026.

Read more

Big appetite for M&A between European and US food and drink companies

3 Dec 2025

Persistent tariffs on EU food and beverage exports have helped drive record levels of M&A activity between European and US companies this year, according to analysis by ING.

Read more

Non-UPF Program extends certification scheme to entire food industry

30 Nov 2025

The Non-UPF Program has extended its certification scheme to the wider food sector, championing a move towards healthier consumption habits.

Read more

Lancet study links UPFs to chronic disease risk

26 Nov 2025

UPFs are consistently associated with an increased risk of diet-related chronic diseases, according to a comprehensive review of global evidence in The Lancet .

Read more

Concerns swirl around cinnamon’s compliance with EU law

25 Nov 2025

Cinnamon may be a top functional ingredient, but it needs stronger protocols to ensure it meets EU food safety laws and quality standards, say researchers.

Read more

Oat Barista: Innovation for game-changing beverages

20 Nov 2025

Oat Barista is a clean label, sustainable, and innovative drink base specifically designed to create the perfect foam in one single ingredient.

Read more

How younger consumers are redefining ingredient choices and rejecting brand loyalty

18 Nov 2025

Gen Z and millennial consumers’ preferences for transparency, functionality, and purpose are “redefining the very nature of consumption itself”, says SPINS.

Read more

Hybrid formats and flexible positioning to disrupt category norms in 2026

17 Nov 2025

Trend forecasters expect food and drink to move more fluidly across occasions, functions, and formats as consumers seek versatility, novelty, and convenience.

Read more