News

Vegetable Juice: A Healthier Alternative to Fruit Juice

18 Jul 2012Vegetables, with their high vitamin and mineral content, are strongly associated with healthy diets. Their share of the fruit/vegetable juice category remains minimal, but with fruit juice gaining a more unhealthy reputation due to its high sugar content, vegetable-based varieties should capitalise on this bad press. Vegetable juice blends have for a long time been […]

Vegetables, with their high vitamin and mineral content, are strongly associated with healthy diets. Their share of the fruit/vegetable juice category remains minimal, but with fruit juice gaining a more unhealthy reputation due to its high sugar content, vegetable-based varieties should capitalise on this bad press.

Vegetable juice blends have for a long time been associated with niche health food cafés and juice kiosks, enjoying little shelf space in major supermarkets and hypermarkets. The best-known brand V8, from Campbell Soup Co, the ninth largest health and wellness (HW) juice player globally, commands only a 1% share of the category. However, the interest in vegetable juice is evident as the brand’s sales stood at US$475 million in 2010 and saw absolute value growth of US$181 million over 2005-2010.

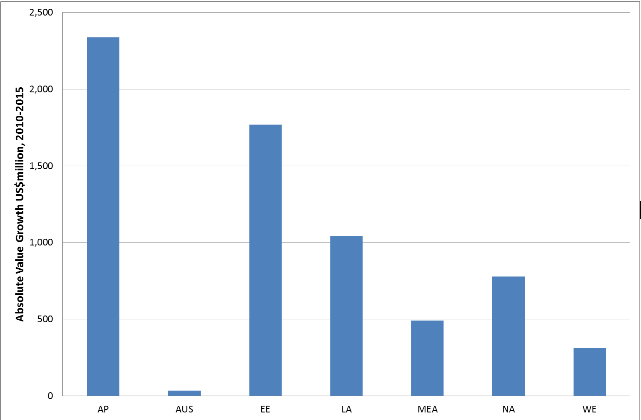

HW juice is set to see absolute value growth of US$6.8 billion over 2010-2015. This strong consumer demand highlights that there is still room for new brands to grow. Interestingly, this growth is set to be driven by emerging market regions such as Asia Pacific, Eastern Europe and Latin America. At present, however, HW juice retail sales are dominated by the North American market.

Regional Absolute Value Growth of HW Juice 2010-2015

Euromonitor InternationalKey: AP = Asia Pacific, AUS = Australasia, EE = Eastern Europe, LA = Latin America, MEA = Middle East & Africa, NA = North America, WE = Western Europe

Lower sugar content

Fruit/vegetable juice has long been associated with health benefits. A study in 2006 found that there was no evidence that fruit/vegetable juice was less beneficial in terms of reducing the risks of developing cancer or cardiovascular disease than whole fruits and vegetables. In addition, just like fruit juice, a 200ml glass of vegetable juice is equivalent to one of your ‘five-a-day’.

In comparison to fruits, vegetables tend to have a lower simple sugar content and therefore a reduced glycaemic response (the rate at which glucose is released into the blood). The sugar content of apple juice and orange juice, two of the most common fruit flavours, is 11.9g/100ml and 10.6g/100ml, respectively, for not from concentrate juice. On the other hand, tomato juice and V8 juice have 4.2g/100ml and just 3.2g/100ml, respectively.

A high intake of sugar is considered harmful to health due to links with chronic health problems such as obesity, type 2 diabetes and cardiovascular disease, all of which are rising and increasingly significant public health concerns not just in developed market but worldwide. In addition, vegetables are less acidic and thus could be more attractive to those consumers concerned about the acid erosion of their teeth.

Big brands showing signs of delving further into vegetable juice

Manufacturers have begun to offer more variety in the way of vegetable juice. The Coca-Cola Co’s brand Pocket Garden Blendie, for example, which launched in France in 2011, includes varieties such as courgette, carrot, tomato and Thai (a mixed vegetable blend of cauliflower, rutabaga, celery and onions).

Other companies include UK-based James White Drinks with its Big Tom (tomato) and Beet It! (beetroot) juice and the Yasai Seikatsu brand from Japan’s Kagome Co Ltd. The latter is so popular in its local market that it is even sold in branches of McDonald’s.

The Coca-Cola Co’s Pocket Garden Blendie Product Range

Euromonitor International. Private label not shy to experiment with vegetable juice

In addition to branded products, private label has also entered the vegetable juice arena. In 2011, private label held an 11% share of global fruit/vegetable juice sales, and whilst the majority of this share is accounted for by fruit juice, private label does offer a number of vegetable variants. Sainsbury’s, the UK’s third largest grocery retailer, has a beetroot, blackcurrant and apple juice while Tesco offers a tropical carrot juice. Both mix well-loved fruit juice flavours with less common vegetable flavours to attract a wider audience. This strategy is important in attracting consumers to a category that remains unfamiliar to many.

Sainsbury’s Beetroot, Blackcurrant & Apple Juice

Euromonitor International. Keep your eye on these flavours

As demand for vegetable juice increases, this could open the door to flavour innovation. At present, the most common vegetable juice flavours are tomato, beetroot and carrot, all of which have numerous health benefits thanks to their high vitamin and mineral content. In addition, these flavours have a somewhat sweeter taste in comparison with other vegetables. Nevertheless, in the future, other flavours such as courgette, spinach, cucumber, pumpkin, kale, celery and parsley, be it as single flavours or as part of a blend of flavours, could have a greater presence.

Related news

PepsiCo formulates ‘naked’ Cheetos and Doritos products

31 Dec 2025

US food giant PepsiCo has launched its Simply NKD range, a move it says reimagines its popular products with new formulations free from artificial flavours, dyes, and colours.

Read more

Debate over ban on ‘meaty’ names for plant-based products reaches stalemate

26 Dec 2025

The debate over a ban on plant-based products using “meaty” terms has reached a stalemate, leaving manufacturers in limbo and still facing overhauls to their marketing and packaging.

Read more

Has ‘clean’ had its day?

22 Dec 2025

Wielding clean-label positioning and fortification as marketing levers is a dangerous strategy, and brands would be better off explaining the hows and whys of the ingredients in their products, say experts.

Read more

Bigging up bean-based products and consumption in Britain

19 Dec 2025

Non-profit organisation the Food Foundation has launched a campaign, “Bang in Some Beans”, designed to increase UK consumers’ legume consumption.

Read more

Ingredient transparency key to success in European natural health market

12 Dec 2025

Europe’s $40.7 billion supplements market is growing fast, fuelled by demand for products that support healthy ageing, mental wellbeing, and preventive health, say experts.

Read more

Sorghum emerges as better-for-you hero ingredient

9 Dec 2025

With the launch of Novak Djokovic’s sorghum-based brand, the grain’s popularity in the better-for-you snacking sphere is on the rise, thanks to its nutritional and sensory properties.

Read more

Innovation promise in 'maturing' plant-based dairy alternatives market

8 Dec 2025

Plant-based dairy is a maturing market that still faces significant hurdles around taste, functionality, nutrition, and price, but industry is innovating fast, according to experts speaking at Fi Europe.

Read more

Celebrating the winners of the Fi Europe Innovation Awards 2025

3 Dec 2025

Food industry stakeholders celebrated as the winners of the Fi Europe Innovation Awards were announced at a ceremony in Paris.

Read more

Yuka’s food scanning app helps consumers make healthier choices

2 Dec 2025

Global food scanning app Yuka helps consumers understand the content of their shopping baskets and shapes producers’ reformulation plans.

Read more

Non-UPF Program extends certification scheme to entire food industry

30 Nov 2025

The Non-UPF Program has extended its certification scheme to the wider food sector, championing a move towards healthier consumption habits.

Read more